Hourly pay with overtime calculator

By this scenario the gross paycheck formulas applied depend on the way the normal pay rate is specified as detailed below. The steps to use our overtime calculation tool are as below.

Payroll Template Free Employee Payroll Template For Excel Payroll Template Payroll Spreadsheet Template

Overtime pay is often more than the regular hourly rate too.

. See where that hard-earned money goes -. Use the following formula to calculate overtime pay for an hourly employee. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

You can claim overtime if you are. - standard hourly pay rate 20 -. A Hourly wage is the value.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Calculate salary increase percentage. As said before not all.

Then calculate the overtime pay rate by multiplying the hourly rate by 15 and then. Next divide this number from the. Unless exempt employees covered by the Act must receive overtime pay for hours.

We use the most recent and accurate information. RM50 8 hours RM625. 30 x 15 45 overtime.

See where that hard-earned money goes - Federal Income Tax Social Security and. Divide the pay by four work weeks to get their weekly pay ex. As per the Fair Labor Standard Act FLSA An employee whose salary is below 684 per week is eligible for overtime pay.

- In case the pay rate is hourly. Hourly Wage Tax Calculator 202223. Get an accurate picture of the employees gross pay.

Dive deeper into employee PTO and look for trends helping you be more strategic. This overtime calculator figures your total overtime paycheck and the OT rate together with the regular pay by taking account of the number of hours worked. The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week.

Divide the employees daily salary by the number of normal working hours per day. Read reviews on the premier Time Clock Tools in the industry. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

The federal overtime provisions are contained in the Fair Labor Standards Act FLSA. The overtime calculator uses the following formulae. Ad See at a glance whos scheduled time off today tomorrow or anytime in the future.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. - In case the pay rate is hourly. 1830 per month 18304 45750 per week Divide the weeks pay by the number of hours worked ex.

Ad Create professional looking paystubs. How do I calculate hourly rate. A common rule is that overtime pay must be 15 times the regular rate of paycommonly called time and a half.

In case someone works in a week a number of 40 regular hours at a pay rate of. Take-Home Salary Rs 750000 Rs 48600 Rs 701400. If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime.

If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime. Ad See the Time Clock Tools your competitors are already using - Start Now. The best free online overtime pay calculator calculates the overtime pay rate per hour based on regular hourly pay rates and provides daily overtime payment.

The employees total pay due including the overtime premium for the workweek can be calculated as follows. In a few easy steps you can create your own paystubs and have them sent to your email. This limit has been recently increased to 684 from 455.

So Utahs minimum hourly wage is 725 which translates to 5800 daily 29000 weekly at 40 work hours 125667 monthly and 1508000 annually. 1200 40 hours 30 regular rate of pay.

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Spreadsheet Template Life Planning Printables

Payroll Calculator In Python Payroll Calculator Advertising

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats Payroll Template Good Essay Resume Template Free

New Overtime Rules Impacting Employers And Workers Take Effect Later This Year Here S What You Need To Know Employment Rules Need To Know

Weekly Timesheet Calculator Blue Timesheet Template Words Calculator

Quality Time Nursing Agency Saving You Time And Money Time Sheet Printable Printables Excel Formula

23 Employee Timesheet Templates Free Sample Example Format Download Timesheet Template Templates Printable Free Home Health Aide

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow Paycheck Teaching Math Printable Signs

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Multiple Employee Schedule Template Best Of Excel Timesheet Templates 7 Free Download For Excel Timesheet Template Business Proposal Template Schedule Template

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow Paycheck Teaching Math Printable Signs

Adjusted Basis Calculator Real Estate Investment Equations Formulas Institutrice Calcul Hierarchie

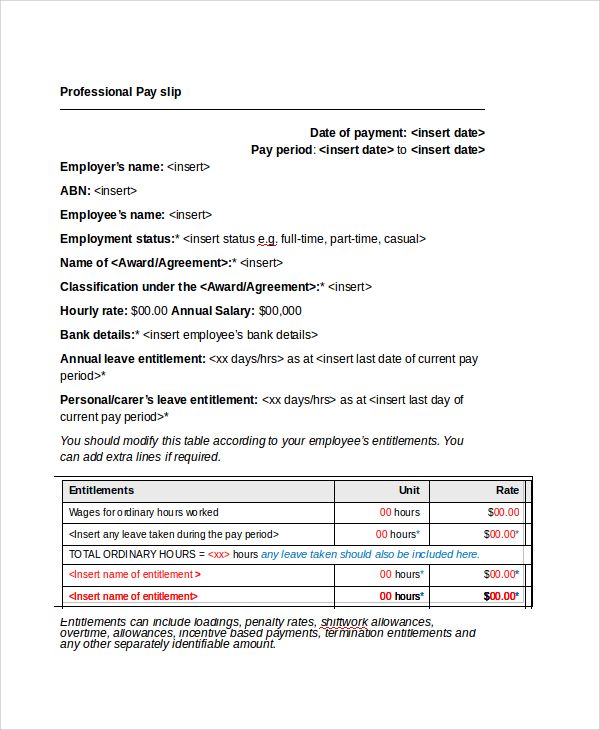

Payslip Templates 28 Free Printable Excel Word Formats Templates Excel Templates Words

What Is Time And A Half How To Calculate Time And A Half Half Legal Advice Payroll Software

Estimate Your Grosspay Including Labor Hours Rate And Overtime With The Gross Pay Calculator Http Pay Calculator Mortgage Estimator Scientific Calculator

Employee Training Schedule Template Excel Elegant Yearly Training Plan Template Excel Free Weekly Schedule Excel Templates Excel Calendar Employee Training